Current National Debt

Our national debt ceiling has gotten ridiculous and from the looks of it, not going to get any better in the future.

"WE THE PEOPLE" OF THE UNITED STATES OF AMERICA ARE

THE ONES PAYING THE DEBT CREATED BY THIS GOVERNEMNT!

One of the main culprits, "is consistently overspending" by our government. The federal government spends more than its budget that it creates a deficit.

In the fiscal year of 2023, Our government spent

roughly $381 billion "more than it collected" in

revenues. Let that sink in!

To pay that deficit, the government borrows

money from federal income tax you pay in, which a budget deficit results.

To pay for this deficit, the "federal

government borrows money" by selling marketable securities

such as Treasury bonds, bills, notes, floating rate notes, and Treasury

inflation-protected securities (TIPS.)

There are three primary drivers of the

overall growth in spending that can be managed:

1. America's aging population

2. Rising healthcare costs, and

3. Rapidly escalating interest

costs

Looking at overspending:

Overspending is spending more money than

one can afford. Our government is doing exactly that which is a common problem when easy credit and "Your Tax Dollars" are available.

The term overspending is also used for

investment projects when payments exceed actual calculated cost.

Breakdown:

Let say, a person working makes $80,000 per year, the physical budget. Why would you buy a $300,000 home? A 30 year loan with a 4.5% APY. 20% Down payment?

1.

Home Amount $300,000 Down: $60,000

2.

Home Amount $100,000 Down $20,000

3.

Home Amount $80,000 Down: $16,000

Looking at the examples:

We can see what "deficit" means in terms. In example: "1,"

Your

annual income of $80,000, you're paying down $60,000 leaving $20,000. The down

payment is 75% of your income.

Your mortgage monthly payment is $1,519,752 verses your income which is a negative 1899.69% or $1,439.752 over budgeted income.

In example 2.

Your annual income of $80,000, you're paying down $20,000 leaving $60,000. The down payment is 25% of your income.

You're mortgage monthly pay is $405 which is 51% or 6.08% annually of your income.

In example 3.

Your annual income of $80,000, you're paying down $16,000 leaving $64,000.

The down payment is 20% of your income.You're mortgage monthly pay is $324 which is 4% or 4.86% annually of your income.

The current level of Monthly Expenses:

| Housing | $2,120 | 31.80% | $25,440 |

| Transportation | $1,098 | 16.47% | $13,176 |

| Food | $832 | 12.48% | $9,984 |

| Personal insurance | |||

| and pensions | $796 | 11.94% | $9,552 |

| Annual miscellaneous | $334 | 5% | $4,000 |

| Mortgage payment | $324 | 4.86% | $3,888 |

| Payroll Taxes | $928 ($214 WKLY) | 1.41% | $11,128 |

| Annual Income | $6,154 ($1,539 WKLY) | 7.69% | $80,000 |

| Annual Expense | $5,503 | 96.46% | $77,168 |

| Annual Net Income | $236 ($55 WKLY) | 3.54% | $2,832 |

ONE CAN NOT LIVE above their income. YET, this Government is doing exctly that! More than two-thirds of revenue come from two taxes - sales and use tax and franchise and excise tax. Who pays these taxes?

"WE THE PEOPLE OF THE UNITED STATES!"

Taxes provide revenue for federal, local,

and state governments to fund essential services like defense, highways,

police, a justice system (if you want to call that) that benefit all citizens.

But very effectively the same citizens, "Are the ones paying it."

Remember, Joe Biden during his miserable

4-year term, provided approximately $61.4 billion assistance, and

approximately $64.1 billion to Ukraine for a total of $125.5 billion. And

again The $95 billion measure includes assistance to Ukraine,

Israel and Taiwan.

Biden's Infrastructure Investment and Jobs Act

was signed into law in November 2021 and contains about $550 billion in

additional investment, to repair infrastructure like roads, bridges and water

pipes and expand passenger rail and broadband.

Yet, the House Republicans wants to cut

Social Security? US Senate committee wants to raise retirement

age?

Report finds that Social Security benefits

would be cut by an average of 13 percent if the

Republicans' plan were fully implemented. Social Security's trust

fund could run out of money as soon as 2033, resulting in a $16500 annual

benefits cut, experts warn. Democrats have called for · Lift

the payroll tax cap · Boost in benefits and changes to the COLA formula.

YES WE ARE IN TROUBLE! This government

"Is out·ra·geous·ly Spending Your Tax Dollars" and YES,

we're the ones suffering from it.

Do you known that Domestic investors, including the Federal Reserve, own around 70% of the U.S. debt? And the remaining 30% is owned by foreign investors and intragovernmental holdings?

As of January 2, 2025, each person "in the United States" has a share of the national debt of $106,024 based on a federal debt of $36.2 trillion which is now $36.5 and rising fast.

Out-of-control spending in Washington is burdening each American with large and growing levels of public debt. Debt per capita in dollars by share of federal debt for child born:

2024: Child Born: $82,590

2040: Age 18: $143,964

2050: Age 30: $209.707

of publicly held federal debt upon becoming an adult. Is this sinking in yet?

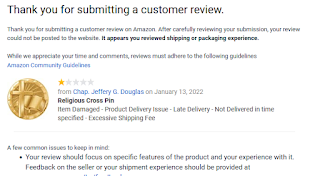

Comments

Post a Comment

Thanks for you Comment. Please visit my website JGDouglas.net