Debt Forgiveness For Cancer Patients

Biden-Harris Administration's Student Debt Relief by President Biden, Vice President Harris, and the U.S. Department of Education have announced a three-part plan to help working and middle-class federal student loan borrowers transition back to regular payment as pandemic-related support expires.

This plan includes loan forgiveness of up to $20,000 for many borrowers and families may be asking themselves “what do I have to do to claim this relief?”

This page is a resource to answer those questions and more. There will be more details announced in the coming weeks Due to the economic challenges created by the pandemic.

My concern is, That "Student Loans" are created by those who went to Collage or sub-collage. "No One" paid any of my student fees when I was going to Online Collage and Trainings.

Biden has committed more than $13.5 billion in security assistance to Ukraine sense taking office. Rising Gas Prices, "so call" inflation has driven products & groceries prices out-the-roof.

Now, Biden and Harris want to relieve a debt that was "Created At Will" and not those who are struggling with Medical Debts, On Fixed income like SSI, SSDI, Prescription Cost and Medical Debt.

It's time "We The People" tell our Government & Congressman to put a stop to it all this nonsense and help those who have fallen ill due to Cancer and other Medical Related Illness brought on by life itself.

Collectively, medical debt in the U.S. stood at $195 billion or more in 2019 according to Kaiser research and 100 million adults have health-care debt with 12% of them owing $10,000 or more.

People ages 35-49 (11%) and 50-64 (12%) are more likely than other adults to report medical debt.

They have greater health needs than younger people on average and aren’t yet old enough to qualify for Medicare coverage, which may protect them from high costs, if at all.

Larger shares of people in poor health (21%) and living with a disability (15%) report medical debt they are unable to pay.

People in these groups are more likely to need and receive care than people in better health and without disabilities.

Among racial and ethnic groups, a larger share of Black adults (16%) report having medical debt compared to White (9%), Hispanic (9%), and Asian American (4%) adults.

Adults who were uninsured for more than half of the year are more likely to report medical debt (13%) than those who were insured for all or most of the year (9%).

Health System Tracker finds that many households do not have enough money available to cover the cost of a typical deductible in a private health plan.

For example, about a third (32%) of single-person households with private insurance in 2019 could not pay a $2,000 bill, and half (51%) could not pay a $6,000 bill.

Comments

Post a Comment

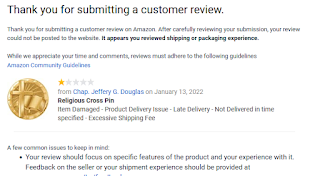

Thanks for you Comment. Please visit my website JGDouglas.net